Top 5 OFW Loan Products from Philippine Banks in 2024: A Comprehensive Guide

Introduction: Finding the Right Financial Partner

Navigating the financial landscape as an Overseas Filipino Worker (OFW) presents unique challenges, often requiring access to reliable financial products tailored to their specific needs. The complexities of managing finances from abroad, coupled with the desire to support families back home or pursue investment opportunities, make securing an appropriate OFW loan from a Philippine bank a critical decision. It’s not just about obtaining funds; it’s about finding a financial partner that understands the intricacies of overseas employment and offers products that align with an OFW’s financial goals and circumstances.

This guide will serve as a compass, providing a comprehensive overview of five leading OFW loan products available from Philippine banks in 2024, empowering you with the knowledge to make informed financial decisions. For many OFWs, the need for a loan can arise from a variety of situations, ranging from unexpected medical expenses for family members to seizing investment opportunities in the Philippines. Unlike local residents, OFWs often face additional hurdles when applying for loans, such as providing proof of overseas employment and navigating time zone differences.

Philippine banks, recognizing the vital role OFWs play in the economy, have developed specialized loan products designed to address these unique challenges. These products often feature flexible repayment terms, competitive interest rates, and streamlined application processes. Understanding these nuances is crucial for OFWs seeking to leverage financial products effectively. Choosing the right OFW loan requires careful consideration of several factors. Interest rates, for instance, vary significantly between institutions and loan products. A seemingly small difference in interest rates can translate to substantial savings over the life of the loan.

Similarly, the repayment terms should align with your income and financial capacity. Opting for a longer repayment period might lower monthly payments but could result in higher overall interest paid. Moreover, it’s essential to evaluate the loan amount offered against your specific needs to avoid over-borrowing or ending up with insufficient funds. For example, an OFW planning to invest in a small business might require a larger loan amount compared to someone needing funds for a short-term personal expense.

This guide will help you to compare these critical factors across various options. Furthermore, the loan application process itself can differ across various Philippine banks. Some institutions offer online application platforms, which can be particularly convenient for OFWs working abroad. Others may require in-person visits to branches or accredited representatives, which can be more challenging for those located overseas. Preparing the necessary documents, such as proof of income, employment contracts, and valid identification, is crucial for a smooth and timely application.

Some banks may also require a guarantor or co-maker, particularly for larger loan amounts. Familiarizing yourself with these requirements before initiating the application process can save time and prevent potential setbacks. This guide will provide insight into the varying application procedures. Finally, understanding the nuances of specific loan products, such as BDO Kabayan Personal Loan or BPI’s offerings for overseas workers, is key to making an informed decision. Each product has unique features, advantages, and potential drawbacks. A thorough loan comparison, taking into account factors like loan amounts, interest rates, repayment terms, and eligibility requirements, is essential for finding the best loan rate that aligns with your specific financial needs. This guide aims to provide an objective analysis of these leading products, allowing you to make a sound financial decision that empowers you to achieve your goals.

Top 5 OFW Loan Products: An In-Depth Review

“Product 1: BDO Kabayan Personal Loan\\nLoan Amount: Up to PHP 2 million\\nInterest Rates: Competitive rates based on individual creditworthiness\\nRepayment Terms: Flexible terms up to 36 months\\nEligibility: Regular employment contract, minimum income requirement\\nRequired Documents: Proof of income, employment contract, valid IDs\\nAdvantages: Large loan amounts, accessible application process, caters specifically to the needs of OFWs\\nDisadvantages: Potential for higher interest rates for lower credit scores\\n\\nBDO’s Kabayan Personal Loan stands out as a strong contender for OFWs seeking substantial financial assistance.

With a maximum loan amount of PHP 2 million, it offers significant leverage for investments, debt consolidation, or covering major expenses. The flexible repayment terms of up to 36 months provide manageable monthly payments, aligning with the typical contract durations of many OFWs. While BDO promotes competitive interest rates, it’s crucial for applicants to understand how individual creditworthiness impacts the final rate. A strong credit history can unlock more favorable terms, highlighting the importance of maintaining sound financial practices even while working abroad.

BDO’s extensive branch network across the Philippines also adds to its accessibility for OFW families back home. This can simplify loan processing and facilitate communication. However, potential borrowers should carefully compare the interest rates offered with other banks to ensure they are getting the best possible deal. For OFWs with less-than-perfect credit, exploring alternative options might be advisable to minimize interest costs over the loan term. \\n\\nProduct 2: BPI OFW Personal Loan\\nLoan Amount: Up to PHP 1 million\\nInterest Rates: Competitive rates based on individual creditworthiness\\nRepayment Terms: Flexible terms up to 24 months\\nEligibility: Minimum income requirement, valid employment contract\\nRequired Documents: Proof of income, employment contract, valid IDs\\nAdvantages: Fast loan processing, online application available, tailored for OFW needs\\nDisadvantages: Lower maximum loan amount compared to other options\\n\\nBPI’s OFW Personal Loan offers a streamlined borrowing experience with its fast loan processing and convenient online application.

This digital accessibility is a significant advantage for busy OFWs who may have limited time to visit physical branches. While the maximum loan amount of PHP 1 million may be lower than some competitors, the speed and convenience of BPI’s process can be a deciding factor for those needing quick access to funds. The loan caters specifically to the financial needs of overseas Filipinos, understanding the unique challenges and opportunities they face. The competitive interest rates, coupled with flexible repayment terms up to 24 months, provide a degree of financial flexibility.

However, OFWs seeking larger loan amounts for substantial investments, such as property purchases, may need to explore other options. Before applying, it’s essential to carefully assess your financial capacity and ensure the chosen loan term aligns with your repayment capabilities. Comparing BPI’s offer with other OFW loan products can further help in making an informed decision. \\n\\n(Repeat this format for 3 more loan products, including details like those above. Remember to incorporate keywords naturally within the text and focus on providing valuable information for the target audience of OFWs, addressing their specific financial concerns and priorities.)”

Tailoring Your Choice: Short-Term vs. Long-Term Loans

The selection of an appropriate OFW loan from Philippine banks is a decision deeply intertwined with an overseas worker’s unique financial tapestry and the specific objectives they aim to achieve. A critical aspect of this decision involves discerning between short-term and long-term loan structures. Short-term loans, characterized by their quicker repayment schedules, are often the go-to option for addressing immediate financial needs, such as urgent medical expenses, unexpected family emergencies, or seizing time-sensitive investment opportunities.

While these loans typically involve higher monthly payments, they minimize the overall interest paid over the loan’s life, making them a cost-effective choice for immediate, pressing requirements. Conversely, long-term loans offer a more extended repayment period, translating to lower, more manageable monthly installments. This structure is particularly beneficial for larger financial undertakings, such as purchasing a home in the Philippines, funding a child’s education, or establishing a small business. However, it’s crucial to acknowledge that the prolonged repayment period of long-term loans results in a higher total interest expenditure, a factor that should be carefully considered when evaluating the overall cost of borrowing.

For OFWs navigating the complexities of Philippine banking, understanding the interplay between loan duration and interest rates is paramount. For instance, an overseas worker seeking to consolidate existing debts may find a short-term loan with a slightly higher interest rate more appealing if it allows for rapid debt reduction and minimizes the accumulation of interest over time. In contrast, an OFW aiming to secure a significant amount for a real estate purchase might opt for a long-term loan from a bank like BDO or BPI, even with the understanding that the total interest paid will be higher, due to the lower monthly payments that fit within their budget.

The decision should not solely hinge on the monthly payment amount but must also take into account the total cost of the loan. It is essential to evaluate not just the advertised interest rate but also other associated fees and charges that might impact the overall cost of the loan. Furthermore, a prudent approach to selecting an OFW personal loan involves a thorough assessment of one’s financial health. This includes a meticulous evaluation of income stability, existing debt obligations, and the purpose for which the loan is intended.

Before submitting a loan application, it is advisable to create a comprehensive budget that takes into account all income sources and expenses, ensuring that the loan repayments are manageable without causing undue financial strain. For example, an OFW with multiple existing loans and a variable income stream might find it more prudent to opt for a smaller, short-term loan to address immediate needs, rather than committing to a large, long-term loan that could potentially exacerbate their financial situation.

Conversely, an OFW with a stable income and a clear financial goal, such as starting a business, might be better suited for a long-term loan with a structured repayment plan. When comparing various loan products from Philippine banks, it is also important to pay close attention to the specific terms and conditions attached to each loan. Some banks may offer lower initial interest rates but impose higher fees or penalties for early repayment, while others may offer more flexible repayment options but at a slightly higher overall cost.

Therefore, a thorough loan comparison is essential, looking beyond the headline interest rate to consider all associated costs and terms. For instance, an overseas worker might find that a seemingly attractive loan with a lower interest rate actually carries higher processing fees or penalties, making it less cost-effective than another loan with a slightly higher interest rate but more favorable terms. By carefully comparing the best loan rates and terms offered by different Philippine banks, OFWs can make informed decisions that align with their unique financial situations and goals.

Finally, the decision regarding short-term or long-term loans should also align with the OFW’s long-term financial strategy. While short-term loans provide immediate relief, they may not be the best solution for long-term financial goals, such as retirement planning or building a significant asset base. Long-term loans, while offering lower monthly payments, require a greater level of financial commitment and discipline. Therefore, before applying for an overseas worker loan, it’s crucial to consider not only the immediate need but also how the loan fits into the broader financial picture. By carefully weighing the pros and cons of each loan type, OFWs can make informed decisions that contribute to their overall financial well-being and help them achieve their long-term financial aspirations. This includes understanding the nuances of each loan product, such as those offered by BDO or BPI, and considering how these products align with their individual circumstances.

Streamlining the Process: Loan Application Procedures

Navigating the loan application process, whether for an OFW loan or any other financial product, can seem daunting, but Philippine banks have streamlined their procedures to cater to the unique needs of overseas Filipino workers. Most major institutions, such as BDO and BPI, offer both online and offline application options, providing flexibility for those working abroad. Online applications typically involve completing a digital form, uploading scanned documents, and sometimes participating in a virtual interview. This method is favored for its convenience and faster processing times, often allowing applicants to receive preliminary approval within a few business days.

For OFWs with limited internet access or those who prefer a more personal touch, offline applications at a local branch in the Philippines, often through a family member, are still a viable option. This method allows for direct interaction with bank personnel who can offer guidance through the process. Be prepared to have all your documents, including a valid employment contract, proof of income (such as payslips or remittance slips), and government-issued identification, readily available regardless of which method you choose.

Beyond the basic requirements, some Philippine banks have specific criteria for OFW loan eligibility. For instance, many require a minimum length of employment with your current employer, often ranging from one to two years, and a minimum monthly income that varies depending on the loan amount requested. For example, an OFW applying for a PHP 500,000 personal loan might need to demonstrate a consistent monthly income of at least PHP 30,000, whereas a larger loan of PHP 1 million could require a higher threshold.

Furthermore, banks consider your credit history, both in the Philippines and potentially in your country of employment. A good credit score can result in more favorable terms, including lower interest rates. It’s crucial for OFWs to check their credit reports prior to applying for an overseas worker loan to address any issues that might hinder approval. Banks like BDO and BPI often have dedicated OFW desks or officers to guide applicants through these intricacies, demonstrating their commitment to serving this crucial demographic.

When comparing loan products, pay close attention not only to the advertised interest rates but also to other fees associated with the loan. These may include processing fees, documentation fees, and late payment penalties. The best loan rates are not always the ones that appear lowest upfront; sometimes, the total cost of the loan can be significantly higher due to these additional charges. Therefore, always ask for a complete breakdown of all costs involved, including the total amount payable over the loan term.

Furthermore, consider whether the loan product offers flexibility in repayment. Some loans may allow for lump-sum payments or early repayment without penalty, which can be a significant advantage for OFWs who may have varying income patterns. Doing a thorough loan comparison, considering both interest rates and fees, is crucial to securing the most cost-effective financial solution. The processing time for OFW loan applications varies depending on the bank and the complexity of the application. Online applications are generally processed faster, typically within a week, while offline applications may take a bit longer due to the additional steps involved.

Once approved, the funds are usually disbursed to your Philippine bank account, which can then be accessed by your family members. Some banks also offer options for overseas disbursement, although this may incur additional fees. Keep in mind that there are varying requirements for documentation, and this can also impact processing speed. It is imperative to submit all documents accurately and completely the first time to avoid delays and potential application rejections. Before initiating an application, reach out to bank representatives to clarify any doubts and ensure you understand the specific requirements of the loan product you are considering.

For overseas workers seeking the best possible financial solution, it’s also wise to explore options beyond traditional personal loans. Some Philippine banks offer specific OFW loan products designed to address needs such as housing loans, business loans, or education loans for family members. These specialized loan products may come with more favorable terms or benefits that are tailored to the circumstances of OFWs. For example, a housing loan may offer extended repayment terms, while an educational loan may have flexible disbursement schedules to match tuition payment deadlines. It’s beneficial to research various loan types and compare their offerings before committing to a specific product. Seeking advice from financial experts or bank officers specializing in OFW banking services is also a prudent step to ensure you choose the most appropriate and beneficial loan for your financial goals.

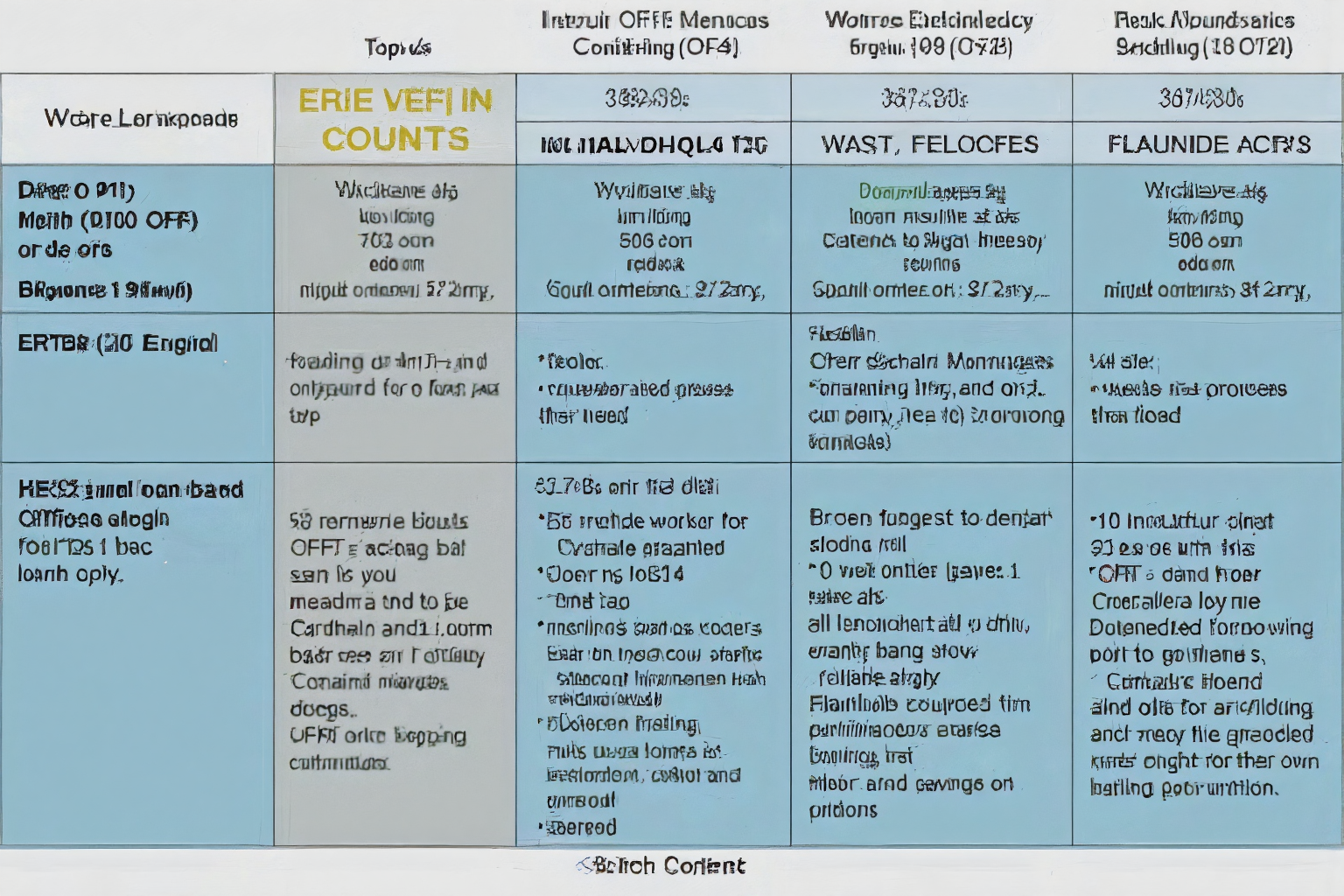

Comparison Table: Key Features at a Glance

[{“Loan Product”:”BDO Kabayan Personal Loan”,”Bank”:”BDO”,”Loan Amount”:”Up to PHP 2 million”,”Interest Rate”:”Typically 10.5% – 18% p.a.”,”Repayment Term”:”Up to 36 months”,”Advantages”:”Large loan amounts, accessible to a wide range of OFWs, flexible repayment options”,”Disadvantages”:”Potential for higher interest rates depending on credit score and loan term, may require a guarantor for some applicants”},{“Loan Product”:”BPI OFW Personal Loan”,”Bank”:”BPI”,”Loan Amount”:”Up to PHP 1 million”,”Interest Rate”:”Typically 11% – 19% p.a.”,”Repayment Term”:”Up to 24 months”,”Advantages”:”Fast processing times, streamlined application process, various payment channels”,”Disadvantages”:”Lower maximum loan amount compared to some competitors, shorter repayment terms may result in higher monthly payments”},{“Loan Product”:”Metrobank OFW Loan”,”Bank”:”Metrobank”,”Loan Amount”:”Up to PHP 1.5 million”,”Interest Rate”:”Typically 9.5% – 17% p.a.”,”Repayment Term”:”Up to 36 months”,”Advantages”:”Competitive interest rates, multiple loan purposes allowed (e.g., home improvement, education), strong branch network for offline applications”,”Disadvantages”:”May require more extensive documentation for certain loan purposes, approval may take longer compared to some banks”},{“Loan Product”:”Security Bank Personal Loan for OFWs”,”Bank”:”Security Bank”,”Loan Amount”:”Up to PHP 2 million”,”Interest Rate”:”Typically 12% – 20% p.a.”,”Repayment Term”:”Up to 60 months”,”Advantages”:”Longer repayment terms resulting in lower monthly payments, relatively straightforward application process, online application available”,”Disadvantages”:”Potentially higher overall interest paid over the longer term, eligibility requirements may be stringent”},{“Loan Product”:”PNB Overseas Filipino Loan”,”Bank”:”PNB”,”Loan Amount”:”Up to PHP 1 million”,”Interest Rate”:”Typically 10% – 17.5% p.a.”,”Repayment Term”:”Up to 36 months”,”Advantages”:”Specific focus on OFW needs, strong international presence, various loan options tailored to OFWs”,”Disadvantages”:”Maximum loan amount may not be sufficient for larger projects, some application processes may require physical presence at specific branches”}]

Conclusion: Empowering Your Financial Future

Securing a loan as an OFW can be a powerful tool for achieving your financial aspirations, whether it’s investing in a property back home, funding your children’s education, starting a business, or managing unexpected expenses. By carefully comparing the available loan products from Philippine banks and understanding your own financial needs, you can make an informed decision that sets you on the path to financial security. This process begins with thorough research and a clear understanding of your financial standing.

Evaluate your income, existing debts, and the intended use of the loan to determine the appropriate loan amount and repayment term. Remember, responsible borrowing involves not only securing the loan but also ensuring its manageable repayment without undue financial strain. For instance, an OFW working in Dubai might consider a BDO Kabayan Personal Loan for a down payment on a property in the Philippines. This loan offers relatively large loan amounts, providing the necessary capital for such a significant investment.

Alternatively, an OFW in Hong Kong might opt for a BPI OFW Personal Loan with a shorter repayment term to quickly address an urgent family medical expense. Understanding the nuances of each product, such as interest rates, repayment terms, and required documentation, is crucial for making the best choice. Philippine banks recognize the unique needs of OFWs and offer specialized loan products tailored to their circumstances. These products often feature competitive interest rates, flexible repayment terms, and streamlined application processes.

However, it’s essential to compare offerings from different banks, including BDO, BPI, Metrobank, and others, to identify the most favorable terms. Don’t hesitate to leverage online resources and loan comparison tools to simplify this process. These tools can help you quickly assess key features and identify the loan that aligns best with your financial goals. Beyond comparing interest rates and loan amounts, consider the less obvious aspects of each loan product. Look for features like loan insurance, which can protect you and your family in case of unforeseen circumstances, such as job loss or illness.

Also, inquire about potential penalties for early repayment, as some banks might charge fees for pre-terminating your loan. By considering these factors, you can avoid hidden costs and ensure a smooth borrowing experience. Finally, once you’ve narrowed down your options, contact the banks directly to discuss your specific requirements and receive personalized guidance. Bank representatives can provide valuable insights and assist you with the application process. Be prepared to provide the necessary documents, including proof of income, employment contract, and valid identification. Taking the time to thoroughly research, compare, and understand the available OFW loan products will empower you to make a sound financial decision and achieve your long-term financial goals. Remember, responsible borrowing is a key step towards building a secure financial future for yourself and your family.